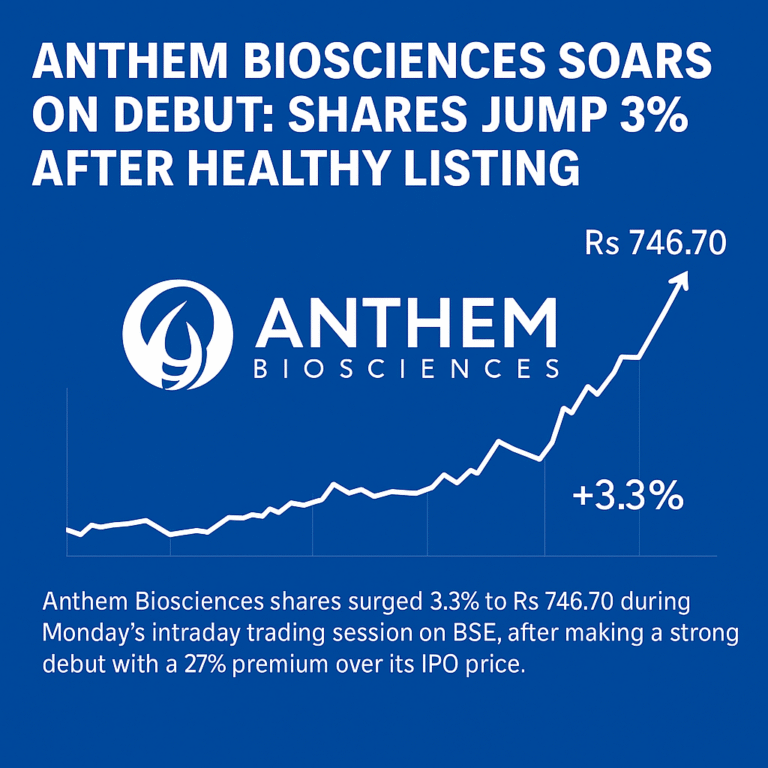

Anthem Biosciences made a powerful debut on the stock market this Monday, opening at ₹723 on the BSE — a solid 27% premium over its IPO price of ₹570. During the intraday session, the stock climbed further to ₹746.70, marking an overall gain of 31% for IPO investors.

Strong Listing Backed by Overwhelming Response

The company’s initial public offering (IPO) witnessed tremendous demand, getting subscribed 67.42 times across all investor categories. Notably, the IPO was an Offer for Sale (OFS), meaning all proceeds went to existing shareholders. Prior to the listing, anchor investors poured in ₹1,016 crore, signaling strong institutional interest.

What Does This Mean for Investors?

According to market expert Prashanth Tapse, Senior VP (Research) at Mehta Equities, while Anthem’s current valuations may seem high post-listing, they are supported by strong business fundamentals and promising long-term potential. He advises investors to “HOLD” the stock with a long-term perspective.

“Anthem’s differentiated capabilities and its position in the growing Indian CRDMO (Contract Research, Development and Manufacturing Organization) sector make it a structurally strong investment,” he told ET.

Targets and Strategy Ahead

Short-term price target: ₹900

Long-term potential: ₹1,000 and beyond

For those who couldn’t participate in the IPO, experts suggest waiting for price stabilisation before entering.

Financial Snapshot

Anthem Biosciences, founded in 2006, operates across the value chain — from drug discovery to commercial manufacturing — in both small molecules and biologics.

In FY25, the company reported:

Revenue: ₹1,930 crore (up 30% YoY)

Net Profit: ₹451 crore (up 23% YoY)

EBITDA: ₹684 crore with a healthy 37% margin

Debt: Minimal

Final Thoughts

Anthem’s stellar debut highlights investor confidence in India’s pharmaceutical and biotech innovation sector. If you’re already invested, it may be wise to stay in for the long haul. If not, keeping an eye on price movements and waiting for the right entry point might be your best strategy.

( Disclaimer: This article reflects market expert opinions and is for informational purposes only. Investment decisions should be made based on personal research or after consulting with a financial advisor.)