Overview

The article presents a nuanced view of India’s investment landscape in the first half of FY26, highlighting a sharp divergence in sentiment between domestic and foreign investors. While Indian firms are ramping up their commitments, foreign companies and the government are pulling back—raising both opportunities and concerns for policymakers.

Key Trends & Insights

1. Domestic Firms: Rising Optimism

- Investment Peak: Indian private sector firms announced ₹9.9 lakh crore in new projects—a 15-month high.

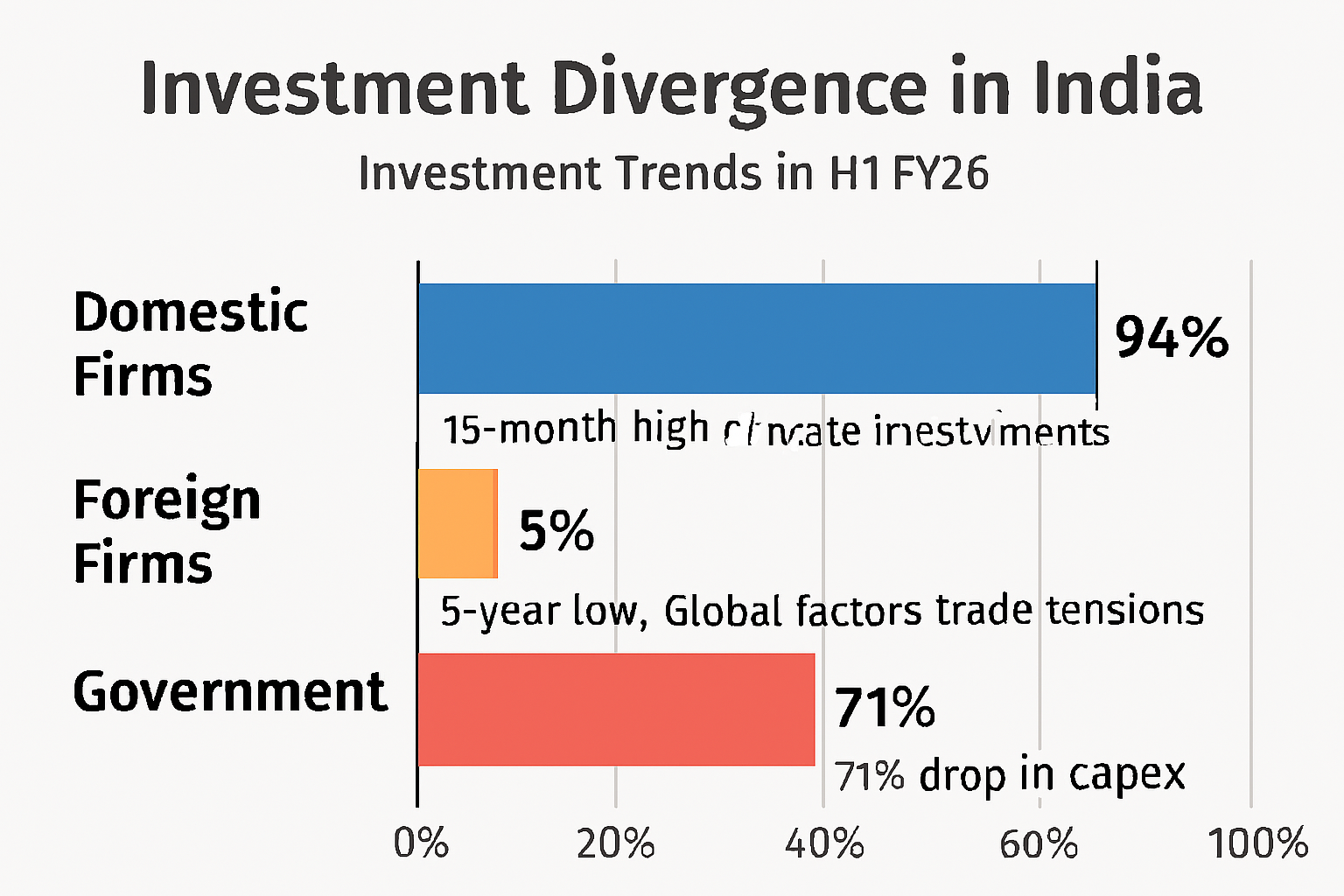

- Dominance: Their share of total private investment rose to 94%, up from 77% in FY19.

- Manufacturing Focus: Most investments are directed toward manufacturing, aligning with national goals like “Make in India.”

- Pre-GST Confidence: Many announcements preceded the August 15 GST rate cuts, suggesting optimism isn’t just tax-driven.

Implication: Domestic firms are increasingly bullish on India’s economic prospects, which could boost employment, industrial output, and fiscal space if these projects materialize.

2. Foreign Firms: Growing Skepticism

- Investment Decline: Foreign project announcements fell to ₹0.6 lakh crore—a five-year low and third consecutive year of decline.

- Global Context: Despite global investment outflows rising 11% in 2024, India hasn’t benefited.

- Tariff Tensions: Recent trade friction with the U.S. may have worsened sentiment, but the downward trend began earlier.

Implication: India’s global investment appeal is waning, and the government must investigate structural or policy barriers that deter foreign capital.

3. Government: Strategic Retrenchment

- Capex Cut: Government investment announcements dropped 71% year-over-year to ₹1.5 lakh crore.

- Policy Shift: This aligns with prior warnings about slower capital expenditure growth.

Implication: With the government stepping back, the onus shifts to the private sector—especially domestic firms—to sustain economic momentum.

Policy Implications

- Urgency for Reforms: The editorial underscores the need for ease of doing business reforms to maintain investor confidence and project execution.

- Fiscal Leverage: If private investments fructify, the government gains more room to address critical areas like defence and development.

- Foreign Investment Strategy: India must reassess its global positioning and address concerns that have led foreign firms to look elsewhere.

Final Takeaway

The editorial paints a picture of domestic resilience amid foreign retreat and government caution. It’s a call to action for policymakers to nurture private sector momentum while re-engaging foreign investors and recalibrating public investment strategies.

Full Credit

The insights, statistics, and policy implications discussed in our conversation are based on the editorial titled “Domestic vitality: On investment announcements, policy implications” published by The Hindu. This piece offers a deep dive into the contrasting investment trends between domestic and foreign firms in India, and the broader economic and policy ramifications.

If you’re interested in reading the full editorial or exploring more of their economic coverage, I recommend visiting The Hindu’s official website.